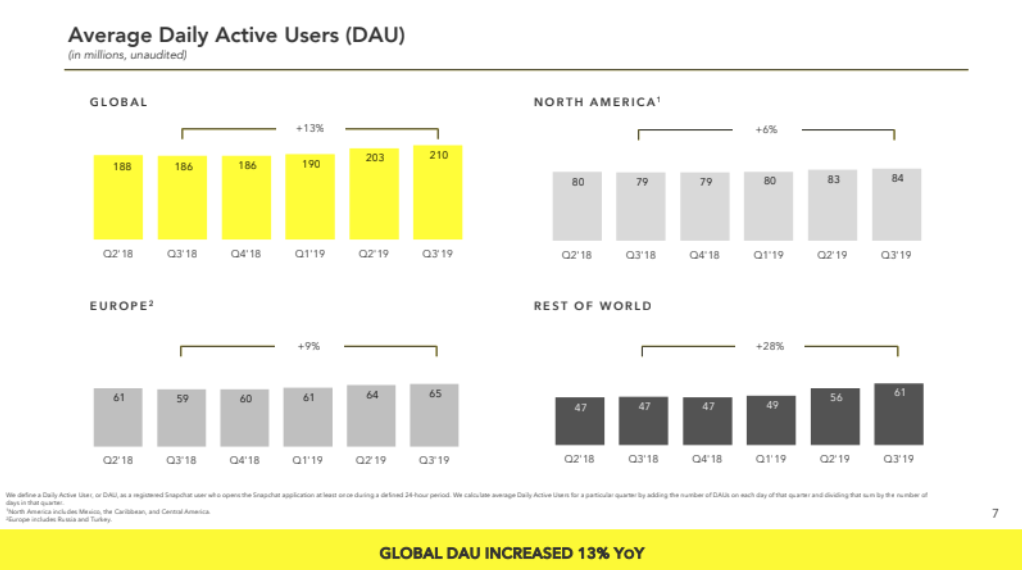

The Snap-back continues. Snapchat blew past earnings expectations for a big beat in Q3, as it added 7 million daily active users this quarter to hit 210 million, up 13% year-over-year. Snap also beat on revenue, notching $446 million, which is up a whopping 50% year-over-year, at a loss of $0.04 EPS. That flew past Bloomberg’s consensus of Wall Street estimates that expected $437.9 million in revenue and a $0.05 EPS loss.

CEO Evan Spiegel made his case in his prepared remakrs for why Snapchat’s share price should be higher: “We are a high growth business, with strong operating leverage, a clear path to profitability, a distinct vision for the future, and the ability to invest over the long term.” Snapchat’s share price had closed down 4% at $14.

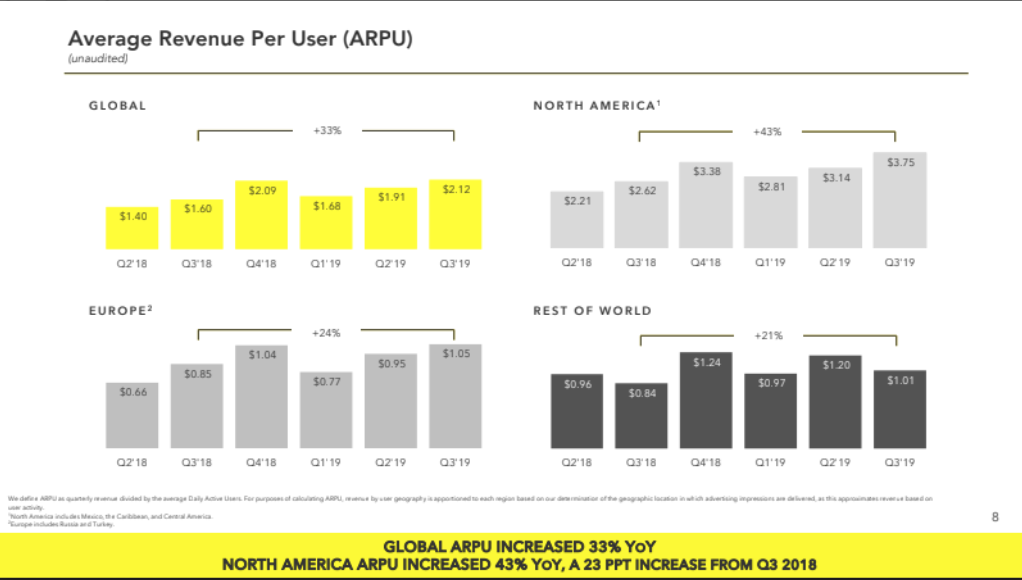

That’s partially because of the high cost of Snapchat’s growth relative average revenue per user. While it notes that it saw user growth in all regions, 5 million of the 7 million new users came from the Rest Of The World, with just 1 million coming from the North America and Europe regions. That’s in part thanks to better than expected growth and retention on its reengineered Android app that’s been a hit in India. But since Snapchat serves so much high-definition video content but it earns just $1.01 average revenue in the Rest Of World, it has to hope it can keep growing ARPU so it becomes profitable globally.

Some other top-line stats from Snapchat’s earnings:

- Operating cash flow improved by $56 million to a loss of $76 million in Q3 2019, compared to the prior year.

- Free Cash Flow improved by $75 million to $(84) million in Q3 2019, compared to the prior year.

- Net loss improved $98 million to $(227) million in Q3 2019, compared to the prior year.

Source: TechCrunch http://j.mp/2MBmPtu

No comments:

Post a Comment